Millennials – It’s Our Bloody Time!

I am 28 years old, and I have questioned myself over the past 12 months – “Is the Great Australian Dream over for me already?” NO CHANCE.

Now, please don’t misinterpret this article write up as another inspirational post to yell out to the world and tell everyone around me that “I AM THE GREATEST”, but more an article on what we need to do as a tight-knit, collective generation that has well and truly been stamped on by the Baby-Boomers of this country in the investment property sector.

My numbers might not always be perfectly stacked up, but my due diligence on areas outside of Sydney has now doubled, if not tripled because I now truly understand the power of what property can do for me in the future. As a kid growing up in Sydney’s western suburb of Bankstown, did I care about the property market back then? Absolutely not.

Why now? Well, besides the obvious reason – 28 years of age and should have most of my life worked out – I wasn’t the brightest kid at school nor was I bottom-of-the-class stupid either, but my attention span was terrible and I couldn’t study for the life of me, literally.

My father has been an avid property investor for as long as I can remember, and has worked in the car industry from a time well before I was even a conceptualised idea. What I did realise with all of that was simple, you did not have to be the sharpest tool in the shed to participate in the housing market, and some of the world’s most narrow-minded people have made some serious cash (and yes, used that cash to live frivolously!) over the years through the right property investments.

I was lucky enough to have my parents break my balls to save up for a property since I was about 17 or 18 years of age, trading off with me a ‘no board to pay’ deal if I saved and purchased a property by a certain time frame. I was young, full of energy and didn’t care for it as much, but slowly I saved up and was eligible for the first home buyers grant back in 2011. I Received my tidy little $7k pay-out from the government and was exempt from Stamp Duty as I actually lived in the unit for the first 6 months.

This month is the 6th anniversary of owning my first home and how do the numbers stack up? I have put on a nice $175K in equity and am positively geared by 7.1% in rental yield. I am no Tim Gurner yet, but I am happy with the growth and numbers I have produced from my small south-western Sydney apartment.

Fast forward my life from back then to now, and I have owned my own business with 3 other very close friends, which I decided to move on from at the end of last year, but have realised that I am back in first gear with getting back into the market for a second time round.

It’s like I went on a 5 year holiday and came back to a completely different world – oh wait, I actually did…

So what the f*** do we do now? NETWORK WITH OUR PROFESSIONAL PEERS. And make sure you network with every professional in the investment, finance and real estate industries as much as possible – if you want to get into, and more importantly ahead in the property investment market that is. Otherwise continue sinking frothies with the lads down at the local (which is still pretty fun too, I must admit).

We need to get a solid understanding of how ‘rentvesting’ can really work for our generation and not just hear it from our enemy, the ‘Boomers.

I do it, my CEO does it and most of the leading property industry experts do it too. It is being done for a reason, and now it’s more important than ever to rentvest as a millennial-aged resident of Sydney because unless you’re on the big bucks and the banks like your financial status (which mind you is becoming harder for more and more people these days) then you probably won’t be able to afford here in Sydney unless it’s a unit in the greater regional Sydney areas – which can also be dangerous if not looked into correctly.

This is a generalisation! Like I mentioned before, my numbers may not stack up perfectly and represent ALL of the millennials across Sydney, but this is derived from my personal studies on it all over the past year.

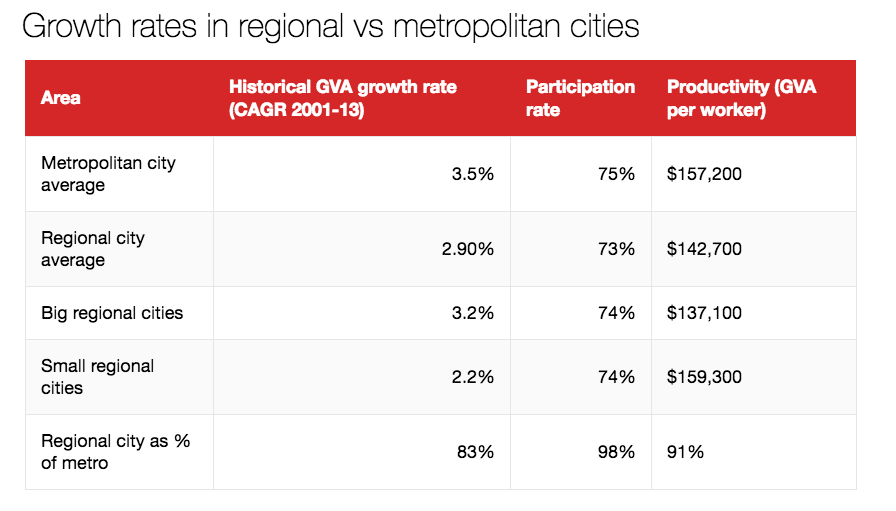

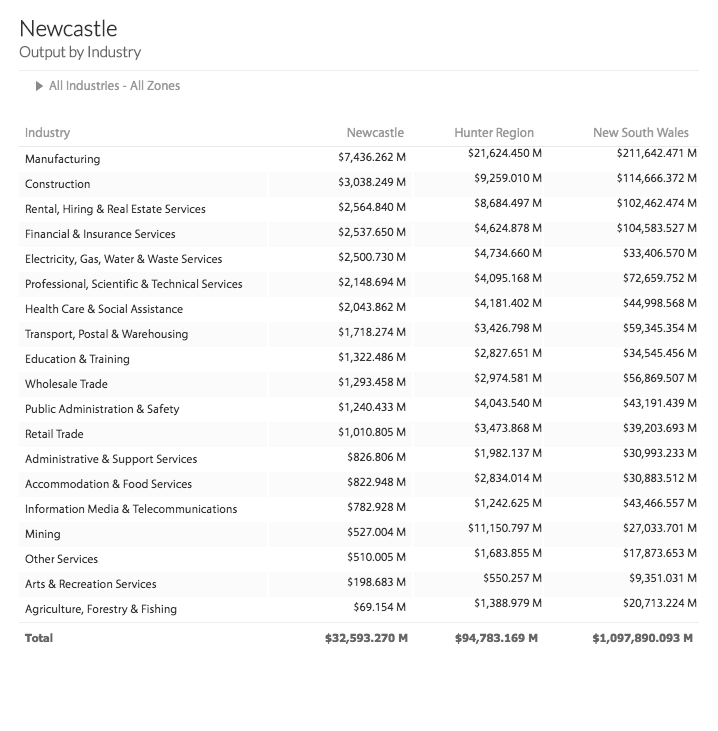

Along with understanding the true value of rentvesting, we also need to thoroughly invest our time into networking with buyer and estate agents alike that specialise in specific areas of interest to us as investors. I have taught my father 4 new property investing methods this year alone through methods taught to me by the buyer agent division of our company, which goes to show that the old ways have proven to be successful for the Baby Boomers, but with a new age comes a new method of strategy to produce the same results, so having older family members and friends of a similar age bracket might not always have the right answer for you. Always remember there is a chance that what worked for them, may not work for you! This is why we need to invest the extra money into buyers agents to help us produce results and educate us on specific areas outside of what we know, because there is a lot of money to be made outside of the Sydney investment property market.

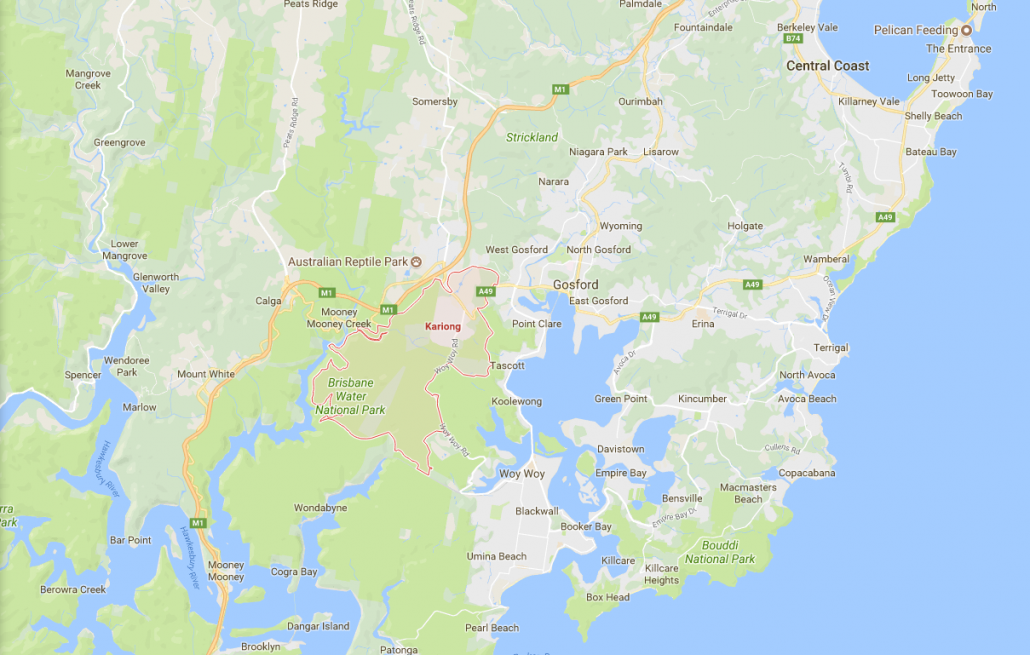

The list can go on, but I hope this small amount of information can benefit the wider audience reading this article today. Just remember, that it is 2017 and there are more people on this planet than ever before, so the network around us is enormous – we just need to leave our comfort zone, pull the task out of the ‘hard basket’ and look a little harder in regional areas outside of Sydney to find some absolute pearler deals. They are out there, the money is out there, you just need to find it and put some effort into finding it these days!